Zen Technology Ltd.: Three years and an 800% multibagger return! Have you seized the chance to gain from this remarkable expansion?

The shares of businesses engaged in the defense sector are known as defense stocks. The primary aim of these companies is to manufacture and deliver goods and services associated with national security and defense. India’s defense stocks have drawn a lot of attention since Russia attacked Ukraine. A number of countries, notably India, have increased their defense spending as a result of the invasion. These nations’ defense stocks are underperforming as a result of the increase in defense spending.

Right now, India is the fourth-largest defence spender in the world. The rising emphasis on military spending suggests that governments all across the world are prioritizing defense. The number of geopolitical disputes between India and its neighbors has increased recently. As a result, India has been boosting its defense budget, which will enable it to keep modernizing its armed forces with cutting-edge equipment.

Through these programs, the government hopes to strengthen the defense industrial sector and promote self-sufficiency in order to successfully counter challenges from its rivals. India made this decision in reaction to growing worries about national security, which forced the government to give priority to building up its own defense capabilities.

In addition, the “Make in India” campaign has given domestic businesses a big boost, motivating them to make capital investments and increase their production capacities. As a result, these businesses are now experiencing favorable business circumstances and increased profitability. Additionally, this increases India’s exports of defense equipment worldwide.

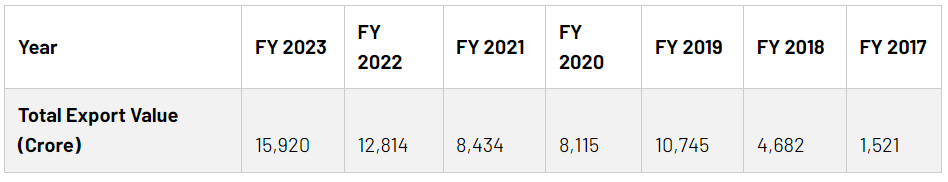

India’s defense exports have reached a historically high level, rising 10 times from FY17 to Rs 15,920 crore in FY23 from Rs 12,814 crore. India’s expanding international presence in the defense sector is demonstrated by the fact that the country currently exports defense goods to over 85 nations.

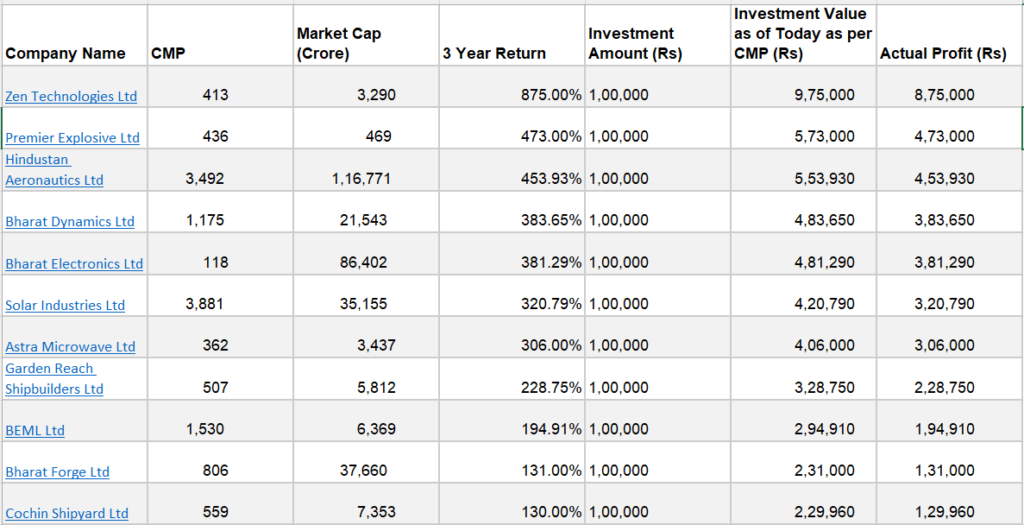

Let’s look at India’s defense stocks and their performance over the previous three years. We will also figure out how much money would have been made overall if someone had invested Rs 1 lakh in each of these equities and kept them up to this point.

Over the past three years, defense stocks have risen astronomically, with gains ranging from 130% to 875%. These stocks outperformed the indices throughout recessions, despite the larger market indices’ inability to generate appreciable returns. It is noteworthy that in just three years, a small Rs 1 lakh investment in Zen Technologies could have yielded a return of over 800%. Similarly, investing in any of the previously mentioned companies would have yielded returns over 100% in the same period of time.

The defence industry is booming right now; make sure to keep an eye on it.

You can also read, how a another Multibagger stock achieve record highs in last three years. https://khabarlane.com/from-rs-282-to-rs-1958-can-this-stock-achieve-record-highs-after-delivering-multibagger-gains-in-three-years/#more-196