The company claims that its parent company, Vedanta Resources (VRL), has lowered its debt by $4.7 billion over the course of two and a half years, bringing its current debt down to $4.8 billion, the lowest level in ten years.

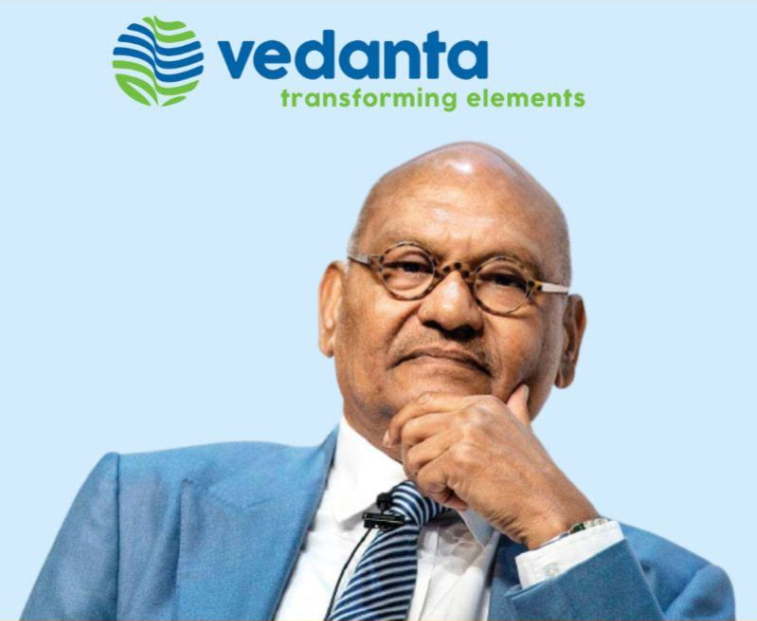

Vedanta, the multinational mining company owned by billionaire Anil Agarwal, announced in an exchange statement on December 16 that it has approved the fourth interim dividend for FY25 at a rate of Rs 8.5 per equity share, or Rs 3,324 crore ($392 million).

The fourth interim dividend of Rs 8.5 per equity share for the fiscal year 2024–2025 was authorized by the board of directors of metal giant Vedanta on Monday.

“The Board of Directors of Vedanta Limited at its meeting held today i.e. Monday, December 16, 2024, has considered and approved the Fourth Interim Dividend of Rs 8.5/- per equity share on face value of Re 1/- per equity share for the Financial Year 2024-25 amounting to Rs 3,324 crore,” As per the statement.

With this, Vedanta has paid out a total of Rs 16,799 crore in dividends for FY25.

According to Vedanta, the interim dividend must be paid within the allotted time frame, and the record date for dividend payments is December 24, 2024.

During the September quarter earnings call, Vedanta Limited stated that the parent company would have a “single-digit cost in the near future” due to Vedanta Resources’ continuous deleveraging and refinancing. The principal would be financed through a regular dividend, while interest obligations would be covered by brand fees.

Vedanta’s FY25 Dividend Timeline

| Ex-Date | Dividend (Rs/share) |

| 24 Dec 2024 | 8.5 |

| 10 Sep 2024 | 20 |

| 2 Aug 2024 | 4 |

| 24 May 2024 | 11 |

According to CFO Ajay Goel, “this will ensure that VRL in future is self-funded,” on November 8.

The business’s encumbered shares held by Twin Star, Welter Trading, Vedanta Mauritius I & II, and Vedanta Netherlands were released by parent company Vedanta Resources on December 6. The group’s level of deleveraging has significantly decreased as a result of the release of encumbered shares, reaching its lowest point in ten years.

Vedanta’s stock fell 1.15 percent at the end of the December 16 session, although it has nearly doubled in 2024 thus far, surpassing Rs 1.9 lakh crore in market capitalization.

Higher metals revenue and a write-back helped the business achieve a net profit of Rs 4,352 crore for the quarter that ended in September. With a net debt to EBITDA ratio of 1.49x, the second quarter’s net debt was Rs 56,927 crore, Rs 4,400 crore less than the June quarter’s. The company’s pre-capex free cash flow is Rs 8,525 crore, a 50% increase from the previous year. In FY25, the company still hopes to reach its highest-ever yearly EBITDA.

Through Qualified Institutions Placement (QIP), the business recently raised Rs 8,500 crore at a share price of Rs 440. This was the biggest issue in India’s metals industry.

The company claims that its parent company, Vedanta Resources (VRL), has lowered its debt by $4.7 billion over the course of two and a half years, bringing its current debt down to $4.8 billion, the lowest level in ten years.

Moody’s Ratings upgraded the Vedanta Resources bond in October, pointing to the company’s strong fundraising activities. Moody’s improved the rating of Vedanta Resources’ senior unsecured notes and changed Vedanta’s corporate family rating from Caa1 to B3.

In July, S&P Global Ratings gave Vedanta Limited an upgrade, stating that the firm had sufficient internal finances to pay off debt by the end of 2025.