ICICI Bank has shown a consolidation breakout together with significant trade volumes, according to an analyst from YES Securities, suggesting a prolonged momentum in the current trend.

Indian benchmark indices ended the day uneven, with a bout of profit booking during the latter part of the session following new highs on Wednesday. The impending budget and the monsoon will be the main short-term market catalysts.

The BSE Sensex ended the day at 77,337.59, up just 36.45 points, or 0.05 percent. The NSE’s Nifty50 index finished the day at 23,516 after falling 41.90 points, or 0.18 percent.

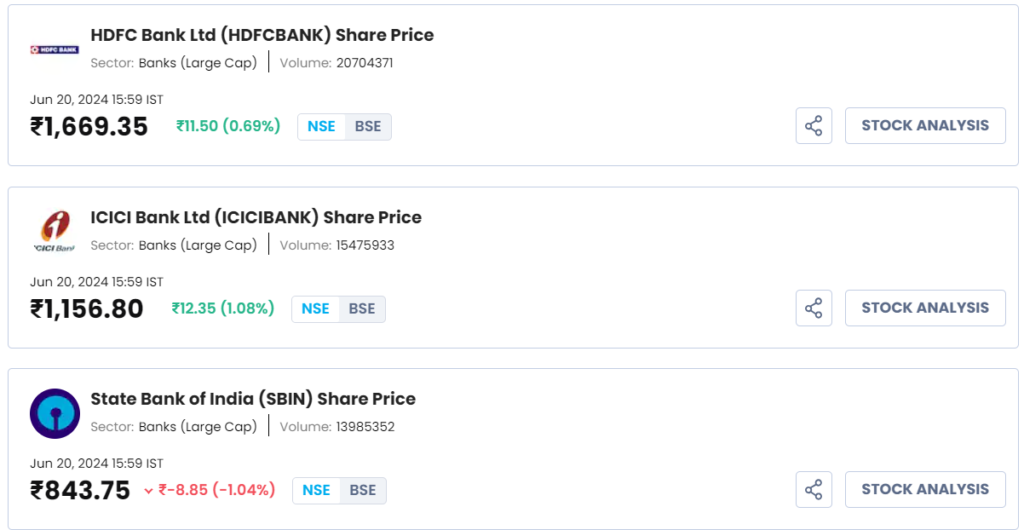

State Bank of India (SBI), ICICI Bank Ltd., and HDFC Bank Ltd. are a few popular banking stocks that are expected to be in traders’ sights throughout the duration of today’s trading session. In advance of Thursday’s trading session, Laxmikant Shukla, a Technical Research Analyst at YES Securities, has the following to say about these stocks:

State Bank of India | Purchase | Stop Loss: Rs. 830 | Target Price: Rs. 910

Based on the historical chart patterns on the daily chart, SBI has gradually declined from Rs 912 to the Rs 731–740 level, where it looks to be bottoming out and consolidating. This area acts as a solid foundation of support. Furthermore, the daily chart shows a positive crossover of the rising RSI, indicating the possibility of further upward momentum. The next target of Rs 910 could be reached in the coming days if there is a clear move over Rs 860, which would suggest additional strengthening.

ICICI Bank | Purchase | Stop Loss: Rs. 1,090 | Target Price: Rs. 1,255

With significant trade volumes and a consolidation breakthrough, ICICI Bank has shown that the current trend is still gaining strength. The momentum indicator RSI, which continuously maintains above the crucial threshold of 55, adds even more credence to the optimistic outlook. When it comes to support and possible gains, the stock has formed a strong base around Rs 1,090 below. It is anticipated that this level will provide support and function as a barrier against any prospective decline.

HDFC Bank | Purchase | Stop Loss: Rs. 1,600 | Target Price: Rs. 1,750

HDFC Bank has successfully broken through its previous month’s peak and is showing indications of emerging from a protracted period of consolidation. The pattern suggests that Rs 1,750 is the immediate goal. On the down side, Rs 1,600 is anticipated to provide as a critical level of support. The current positive momentum is being supported by both the RSI and MACD indicators. The RSI is positively poised and confirms the bullish attitude, while the MACD shows strength. In light of these variables, we advise purchasing Biocon between Rs. 1,640 and Rs. 1,660, with a closing stop loss set at Rs. 1,600 and a target price of Rs. 1,750.

Disclaimer: Khabar Lane does not offer investment advice; the news it covers about the stock market is provided solely for informative purposes. It is recommended that readers get advice from a licensed financial advisor prior to making any investing decisions.