Nifty and Sensex, the benchmarks for Indian equity, reached fresh heights of 24,124 and 79,546 respectively. The increase is being driven by robust fund flows, and market participants are still confident.

Plenty of bull runs! On June 28, Indian equities indexes hit fresh highs as they carried on with their positive trend for a fifth day in a row. This year, the benchmark Nifty has reached a record high for the 25th time. The benchmark has already produced returns of more than 10% in 2024.

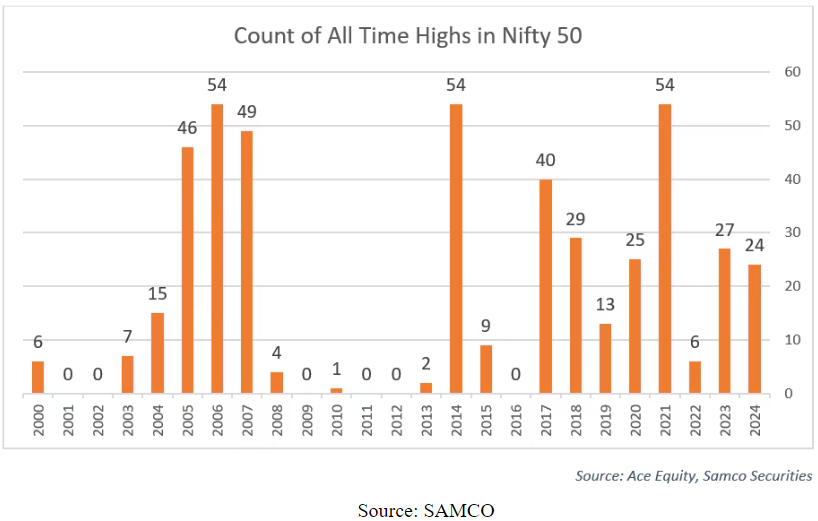

The Nifty reached record highs 27 times in 2023 alone, which is a noteworthy accomplishment. In just the first half of 2024, it is already getting close to the number of new heights reached for the course of the previous year, almost reaching this milestone. Three years in particular—2006, 2014, and 2021—have had the most amount of Nifty record highs since 2000, with a total of 54 highs throughout these times. Six additional years, 2001, 2002, 2009, 2011, 2012, and 2016, saw no new high, though.

The Sensex reached a record high of 79,546 while the Nifty shot to an all-time high of 24,124. In the previous session, on June 27, Nifty crossed the psychological threshold of 24,000. It is noteworthy that the increase from 23,000 to 24,000 only required 23 sessions, as opposed to the 88 sessions required to go from 22,000 to 23,000 in May 2024.

In the previous session, the Sensex also crossed the 79,000 barrier for the first time, indicating a robust and ongoing level of confidence in the Indian market, supported by both robust buying in blue-chip companies and good fundamentals in important industries.

Bulls couldn’t have hoped for a better outcome following what transpired on the day the election results were declared. In just three trading sessions, the index made up all of the losses it sustained on Election Day. Fund flows are mostly to blame for what may have been one of the fastest recoveries in Indian capital markets history, according to Apurva Sheth, Head of Market Perspectives & Research at SAMCO Securities.

Sheth went on to say that if you look at FPI’s fund flow statistics from Sebi, you can see that they had purchased for the last 12 sessions, which ran from June 10 to June 26. Almost ₹32,087 crore has been invested in Indian equities markets by them. During the same time frame, DIIs had invested ₹20,002 crore. Just on election day, individual investors purchased equities valued at ₹21,179 crore.

As a result, for the past two weeks, market players have been purchasing stocks left, right, and center, mostly driving the markets higher.

Though there are worries that the market may be overbought, analysts are still positive that this rally will continue in the near future. They point to significant increases in large-cap stocks as a major engine of market momentum.

“Despite worries about value, this rapid increase points to a positive picture for the Indian market. The current trend suggests that, prior to the Union Budget, the Sensex may shortly reach a new high. This increasing trend is being driven by large-cap equities, especially those in the banking and telecom industries, whose strong fundamentals reflect the optimism of the market and investor confidence. These industries are probably going to keep assisting the market’s upward trajectory in the future, according to Trivesh, COO Tradejini.

The chief investment strategist of Geojit Financial Services, VK Vijayakumar, expressed confidence in the near future sustainability of the current bull run in Indian markets, which is mostly being driven by large-cap companies. He emphasized the likelihood of higher foreign investment into India, pointing out that the country’s macroeconomic foundations are stronger than those of other growing economies.

In response to worries over market overvaluation, Vijayakumar rejected the idea that a bubble was developing, pointing out that the Nifty’s Price-to-Earnings (P/E) ratio of 21x FY25E earnings is still below the 23x P/E ratio that is thought to represent the bubble’s threshold. He emphasized that there are no appreciable overheating risks at this valuation level, supporting ongoing market optimism.

Moving forward, Sheth pointed out that July has been one of the most optimistic months for Indian equity markets in terms of seasonality. With an average gain of 3.3%, the Nifty has finished the last ten years on the up side.

With bulls firmly in control and a number of favorable factors working in their favor, including liquidity, seasonality, and momentum, it is reasonable to anticipate that the rally will continue in July, with an index target of 24,500.

SVP of Research at Religare Broking Ajit Mishra anticipates that the current bull trend will hold. He believes that IT and FMCG, after the banking industry, will be critical to sustaining the upward trend. The Nifty could test 24,500 after breaking through the 24,000 barrier, with support located at 23,600. Mishra suggested that participants adjust their positions appropriately and search for opportunities to purchase on dips.

Resistance levels at 24,200 and 24,450 indicate that Rahul Sharma, Head of Technical and Derivatives Research at JM Financial Services, believes momentum will continue.

During the current record-breaking rally, VK Vijayakumar of Geojit Financial Services suggested investing in large-cap companies. He advised against making significant investments in small-cap stocks at this time.

Disclaimer: The stock market news provided by Khabar Lane is intended solely for informative purposes and should not be interpreted as financial advice. It is recommended that readers get advice from a licensed financial advisor prior to making any investing decisions.