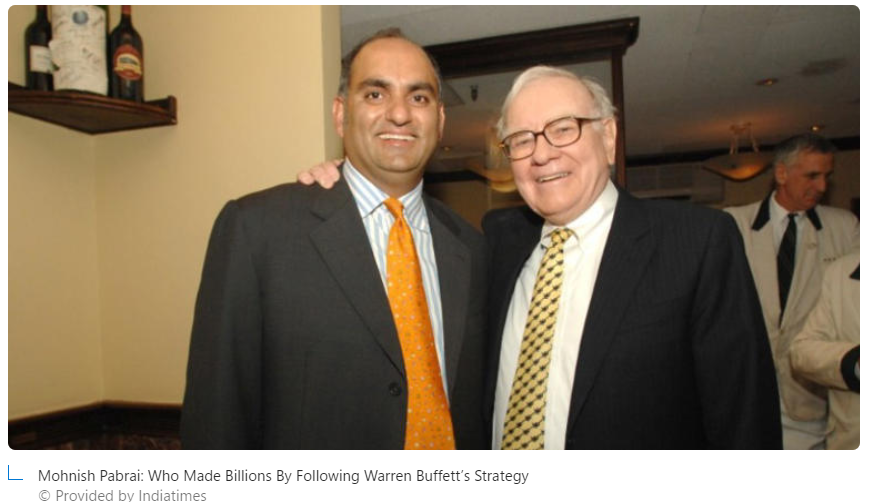

Mohnish Pabrai is an Indian-American investor, philanthropist, and author known for his value investing approach, closely modeled after the principles of Warren Buffett and Charlie Munger

Pabrai began his career in the tech industry, working for Tellabs, a telecommunications company, and later founded his own IT consulting firm, TransTech, Inc., in 1991.

His early successes included Satyam Computers in 1995, which saw his investment appreciated by 140 times in 5 years. Pabrai wisely sold the stock in 2000, just before the dot-com bubble burst, pocketing a handsome profit of $1.5 million. He then multiplied this capital to $10 million in less than five years.

In 1999, he sold TransTech for approx. $6 million, Pabrai launched Pabrai Investment Funds, an investment firm modeled after Buffett’s investment partnerships. His “heads I win, tails I don’t lose much” approach to investing is working. His portfolio concentrates on India and emerging nations, as he doesn’t find many mispriced or undervalued stocks in the U.S. market. If someone invested $100,000 in July 1999 with Pabrai, that investment would have grown to $1.8 million by March 2018.

“I’m a shameless copycat,” Pabrai candidly admits. “Everything in my life is cloned…. I have no original ideas.” However, even imitation requires a dose of common sense.

In 2008, along with his close friend and fellow investor Guy Spier, Pabrai made a substantial investment of $650,000 to secure a lunch meeting with Warren Buffett. Fast forward to March 2022, Pabrai earned accolades from none other than Buffett himself for his philanthropic endeavor, Dakshana.

Circling the wagons in five minutes! pic.twitter.com/KQB62c3RMs

— Mohnish Pabrai (@MohnishPabrai) October 13, 2023

Pabrai’s Investment Strategy divided in 3 parts :-

Cloning: Pabrai is known for his “cloning” approach, where he studies and emulates the investment strategies of successful investors like Warren Buffett, Charlie Munger, and others.

Concentrated Investments: He believes in maintaining a concentrated portfolio of high-conviction stocks, typically holding around 10-20 positions at a time.

Long-Term Focus: Pabrai emphasizes long-term investments in businesses with durable competitive advantages and strong management.

Philanthropy:Pabrai founded the Dakshana Foundation in 2007, which focuses on providing educational opportunities to underprivileged students in India. The foundation offers intensive coaching programs to help students prepare for entrance exams to prestigious engineering and medical colleges.