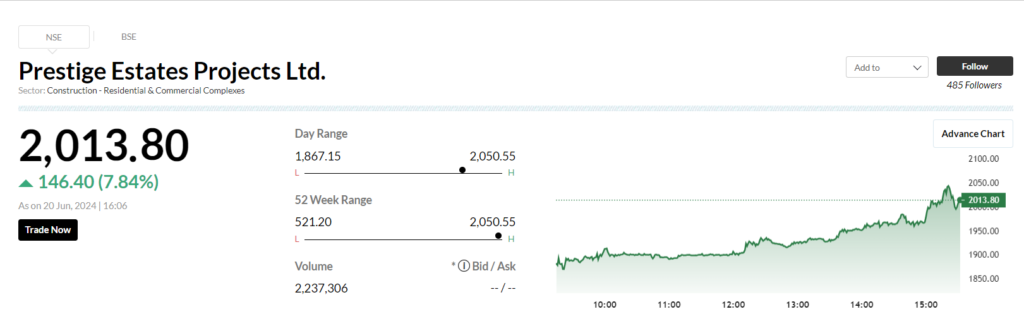

Multibagger stock: Today, Prestige Estates shares closed at Rs. 1958.20 on the BSE, up roughly 5% from yesterday’s closing of Rs. 1867.20. Prestige Estates’ market value increased to Rs 78,242 crore.

Over the past three years, Prestige Estates Ltd. shares have produced multibagger gains. The real estate stock saw gains of 593% during the current session, peaking at Rs 1958.20. It had closed at Rs 282.25 on June 18, 2021. By contrast, in just three years, the BSE 500 index increased by 65.12. On June 18, 2024, Prestige Estates shares reached a record high of Rs 1,999.95, while on July 13, 2023, they reached a 52-week low of Rs 521.

Prestige Estates’ shares increased by over 5% to Rs 1958.20 today from the BSE close of Rs 1867.20 earlier in the day. A total of 0.20 lakh of the company’s shares were traded, generating a revenue of Rs 3.78 crore. Prestige Estates’ market value increased to Rs 78,242 crore on the BSE. The one-year beta of Prestige Estates shares is 1.2, suggesting significant volatility over that time.

Technically speaking, Prestige Estates’ relative strength indicator (RSI) is 62.8, indicating that it is neither trading in the overbought or oversold areas.

The stock of Prestige Estates is now trading higher above the moving averages for the next five, ten, twenty, thirty, fifty, hundred, 150, and 200 days.

The stock’s price objective has been increased to Rs 2,320 by international brokerage CLSA, which has maintained its ‘Buy’ rating.

Prestige Estates’ valuations are still lower than those of its peers, and the brokerage anticipates that this re-rating will continue because debt concerns seem exaggerated. It said,”Operational cash flow will significantly support its capex and project pipeline growth.”

The real estate stock is rated as a buy by Elara Securities, with a price target of Rs 2300 per share.

“Prestige Estates Projects, driven by planned launches of Rs 60,000 crore, is guiding a presales growth of 25% YoY in FY25.” Its strong presence in its native Bengaluru market, where it often commands a 10 percent volume market share, lends credence to this.

Due to lower income, Prestige Estates reported a 70% decline in consolidated net profit at Rs 140 crore for the quarter that ended in March 2024. Its net profit for the previous year was Rs 468.4 crore.

From Rs 2,938 crore in January through March of FY23 to Rs 2,232.5 crore in Q4 of the previous fiscal year, total income decreased. Net profit increased to Rs 1,374.1 crore in the fiscal year 2023–24 from Rs 941.8 crore the year before. From Rs 8,772 crore in 2022–2023 to Rs 9,425.3 crore in the most recent fiscal year, total income grew.

For more details please follow the link below

Disclaimer: The stock market news provided by Khabar Lane is intended solely for informative purposes and should not be interpreted as financial advice. It is recommended that readers get advice from a licensed financial advisor prior to making any investing decisions.